A deep-dive into the price dynamics of Soybean Futures (ZS)

- Yi Xuan

- Aug 18, 2024

- 4 min read

Soybean is one of the most important grain products in the world.

To become a competent Soybean futures (ZS) trader, I believe it is of the essence for one to understand the dynamics of the soybean market.

In this post, I'd like to discuss the interesting price dynamics of Soybean Futures (ZC).

Let's get going!

Related posts:

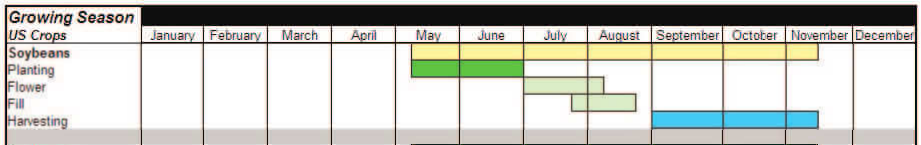

Growing schedule of Soybean

The US is one of the most important producers of global Soybean supply.

In the US, the planting schedule of Soybean is as below:

April - June: Planting season

July - August: Mid-season (Flowering and Filling)

September - November: Harvesting season

The underlying growing schedule of Soybean forms a unique dynamic for both Soybean supply and price.

Concept: Marketing Year of Soybean

Given the planting schedule of Soybean, it has a marketing year from 1st of September (the beginning of Harvest month) to 31st of August of the following year.

Old crop vs New crop

The planting schedule for Soybean determines the source of Soybean supply at any particular time:

Old crop

During the planting months (April - August), the source of Soybean supply available for purchase by consumers is from the crops harvested during the previous harvest season - the old crop.

New crop

Towards the end of harvest season (November), newly harvested crops, or new crop, come to the market and supply becomes higher.

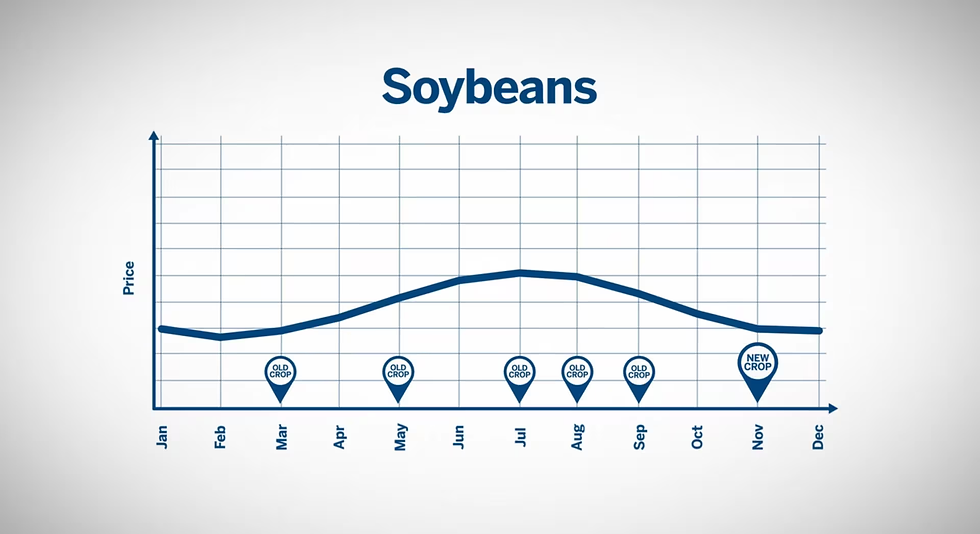

Soybean has one new crop futures delivery month (November) and all others are considered old crop months:

From the chart above, Soybean prices tend to reach their peak and decline in July/August, continuing through a flat "February break", and reaching their seasonal high as they approach the summer months.

July and August: The most important and volatile time of the year for Soybean

The mid-season of Soybean (July & August) is one of the most crucial months of Soybean growing phase, as it is where the flowering and filling phase happens, which influences the final yield of Soybean.

As such, July and August tend to be the time of the year with the most uncertainty in the whole Soybean growing season.

Any critical drought or extreme weather conditions in July and August would cause huge price fluctuations. Meanwhile, a favourable weather condition in July and August would bring more certainty and stability to the Soybean market.

Generally, the months of July and August are the most volatile months for Soybean:

Price dynamics we can observe in Soybean Futures

#1 Old crop dynamic traded in the same marketing year

The first form of soybean price dynamic can be seen between old crop soybean futures contracts:

Soybean Futures Storage & Carrying Cost Dynamic:

The chart below compares the price of Soybean January 2024 (blue line) and March 2024 (orange line) futures contract in 2023. Both are considered old-crop futures contracts traded in the same marketing year.

Prior to August 2023, there were still many uncertainties around the mid-season phase of Soybean due to unclear weather conditions. As such, near-month futures contract (January, blue line) was priced at a premium over far-month futures contract (March, orange line) due to uncertainty.

As time passed, a clearer weather condition led to more clarity in soybean yield and harvest. As such, starting in August, March contract began to be priced higher than the January contract.

This is due to the existence of storage and carrying costs for the inventories which begin to be priced-in to far-month Soybean contracts.

#2 Old crop-New crop dynamic

The price for old soybean crops tends to remain strong until prospects for new crops are better known.

Therefore, prices for old crops are likely to remain strong until the new batches of crops get through critical planting stages, usually in July and/or August.

Soybean Futures Old Crop-New Crop Dynamic:

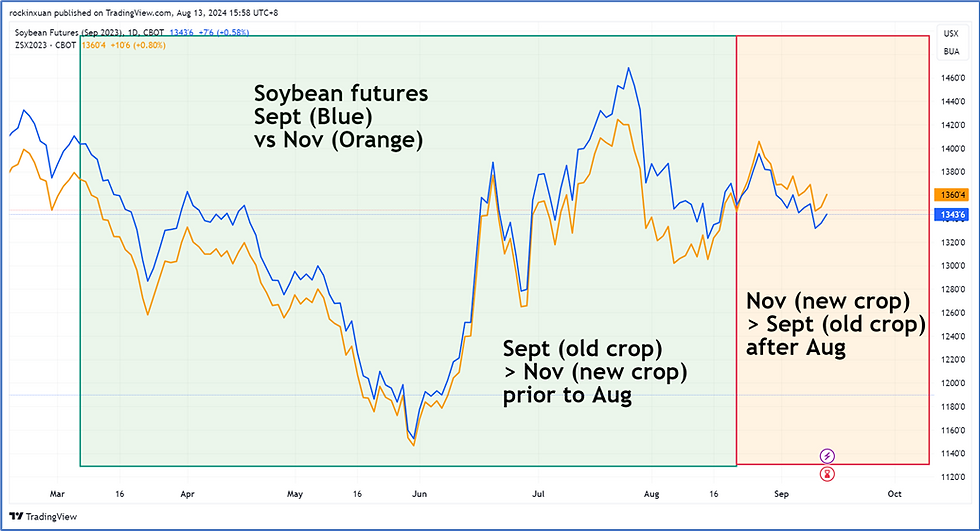

The chart below compares the price of Soybean September 2023 (blue line) and November 2024 (orange line) futures contract in 2023.

September 2023 contract is considered an old crop contract, while November 2023 is considered a new crop contract.

Since the September contract (Blue line) represents old crops, it was priced at a premium BEFORE new crops passed the critical mid-season month of July/Aug due to a low supply of old crops towards the end of the marketing year.

AFTER August, once there was more certainty over the yield and potential harvest of new crop, the November soybean contract (Orange line), which represents new crop, was priced higher against the September old crop contract (Blue).

Verdict: Understanding the price dynamics of the Soybean market is crucial to trade Soybean futures

With this post, I hope it gives clarity on how the soybean market works, especially the dynamics between two old crop futures contracts, and the dynamic between an old crop and new crop contracts.

Subscribe for more content on Algorithm and Futures Trading!

Now, it is impossible for me to go through trading in detail in a short article like this.

But don’t fret, consider subscribing to ALgopedia's FREE newsletter at the bottom of this post, and be the first to know when we publish any new updates!

Disclaimers

Any of the information above is produced with my own best effort and research.

This post is produced purely for sharing purposes and should not be taken as a buy/sell recommendation. Past return is not indicative of future performance. Please seek advice from a licensed financial planner before making any financial decisions.

Leverage is a financial tool that comes with its advantages and risks. Please learn and understand both the upsides and downsides of leverage before using it for trading.

Comments